A Gift of Active Love

that Lasts Generations.

From our offices in North Carolina and Florida, the team at TrustCounsel serves clients throughout North Carolina, Florida, New York and Tennessee.

OUR PRACTICE AREAS

Estate Planning

An estate plan is an essential consideration for all individuals, no matter your age or situation. A basic estate plan can help to provide certainty for various scenarios in the event that you become incapacitated or upon your death.

Trusts

While you may think trusts are only for the extremely wealthy, they are a great legal tool for managing and protecting your assets. Our trust attorneys help you through the process of creating a trust that will best protect your family and your assets.

Probate

Probate is the legal process through which a deceased person's will is validated, and their assets are distributed according to the terms of the will or, in the absence of a will, according to applicable laws. The primary goals of probate are to ensure the proper distribution of the deceased person's assets, settle their debts, and resolve any claims against the estate.

Business Entity Formation

Business entity formation refers to the process of legally establishing a distinct and separate organization that conducts business activities. Choosing the right business structure is a critical decision for entrepreneurs and business owners, as it affects various aspects of the business, including liability, taxation, and management.

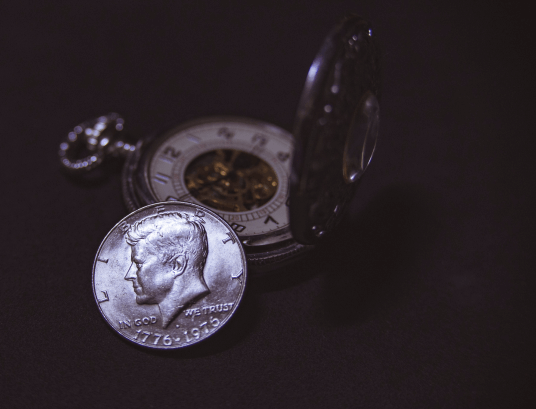

Asset Protection

Asset protection refers to a set of legal strategies and financial planning techniques designed to safeguard an individual's or a business's wealth and assets from potential risks, threats, or liabilities. The goal of asset protection is to minimize the impact of unforeseen events, such as lawsuits, creditor claims, bankruptcy, or other financial challenges, by legally and strategically organizing assets in a way that makes them less vulnerable to seizure or loss.

TRUSTCOUNSEL

WHO WE ARE

Our team of attorneys at TrustCounsel has well over 100 years of combined experience. As estate planning attorneys, we like to say that we specialize in Peace of Mind. Whether you are just starting out or looking back at a life well-lived, we can craft a comprehensive estate plan based on your goals and wishes. We can help you protect your family, preserve your assets, and save taxes, not to mention avoid probate.

When a loved one has passed away, we can ease the legal and financial burdens that follow. We have handled thousands of estate and trust administrations, including related tax planning and compliance. Let us help you with the probate process – our attorneys can even serve as personal representative (executor or administrator) and or trustee.

READ OUR ESTATE PLANNING GUIDE

Succession Strategies: Planning for Family Business Continuity

Family business succession planning is a critical process that involves preparing for the transition of management and ownership to the next generation. It ensures that the business continues to thrive and that your legacy is preserved. Here are some key steps and considerations in family business succession planning: Start Early: Begin planning years in advance. This allows ample time for training successors, testing their leadership abilities, and making necessary adjustments. Identify Successors: Determine who in the family is willing and capable of taking over key roles. This can be a sensitive issue, so it’s important to consider the interests and strengths of potential successors objectively. Develop a Formal Training Plan: Once successors are identified, create a detailed plan to prepare them for their future roles. This should include working in various parts of the business, formal education, and possibly external professional experience. Establish Governance Structures: Setting up clear governance frameworks

CONTACT

TRUSTCOUNSEL

CHAPEL HILL, NC

1414 Raleigh Road

Ste. 203

Chapel Hill, NC 27517

CHATHAM COUNTY, NC

50101 Governors Drive

Ste. 155

Chapel Hill, NC 27517

NAPLES, FLORIDA

1415 Panther Lane

Ste. 534

Naples, FL 34109

( BY APPOINTMENT ONLY )